Is Debt Consolidation Right for You?

Determining if a Debt Consolidation Loan is acceptable includes evaluating private monetary targets. For these struggling with excessive levels of unsecured debt and looking for a way to handle funds higher, consolidation is normally a beneficial strategy. Alternatively, if the debt is manageable and funds are being made consistently, it might be clever to continue with the present met

Explore BePick for More Insights

BePick stands out as an essential useful resource for freelancers looking for detailed information and reviews relating to loans available to them. With a concentrate on transparency and consumer feedback, BePick offers a complete overview of varied lenders, their offerings, and buyer experien

Furthermore, BePick features monetary tools, similar to calculators that assist users in estimating potential repayments. This performance empowers borrowers to visualize their financial commitments earlier than continuing. Overall, BePick stands as a crucial ally for anybody exploring credit lo

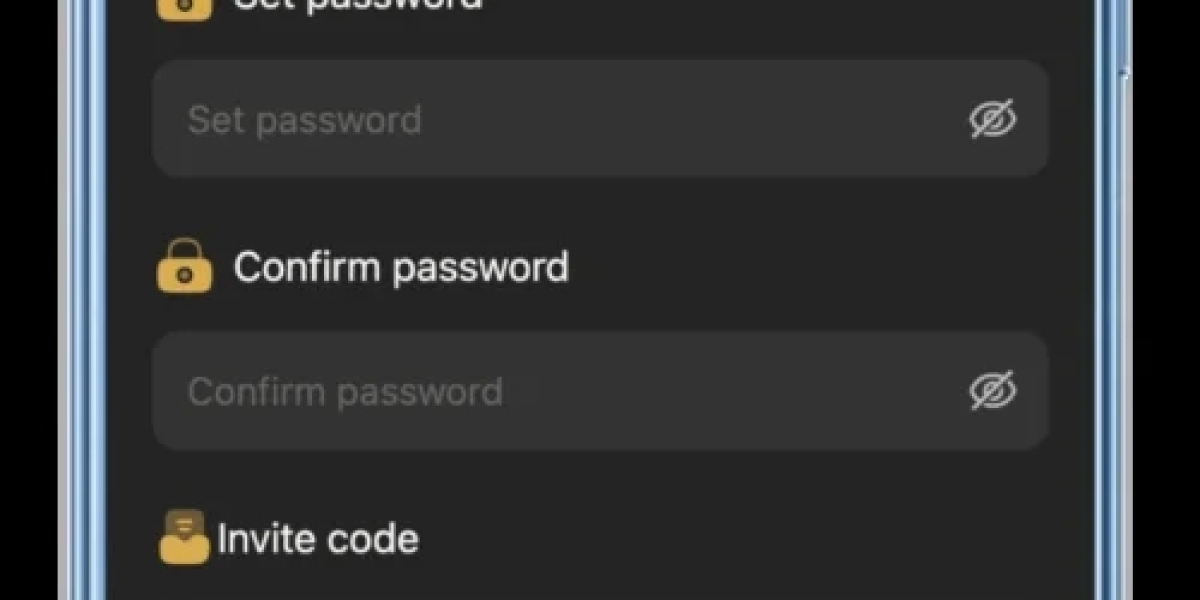

Typically, lenders providing these loans leverage know-how to expedite approvals, using online functions and automatic methods. This means that once you submit your utility, the lender can quickly confirm your information and decide whether or not to approve the mortg

Once the documents are prepared, borrowers can apply online or in person. Many lenders provide an easy-to-navigate on-line utility that can lead to quick approvals. After submitting the appliance, debtors typically await a call, which can range from minutes to a number of d

Home equity Credit Loan loans and lines of credit are another choice, commonly utilized by homeowners. They can supply lower rates of interest because they're secured by the home’s equity. However, this feature additionally carries dangers, as failure to repay might lead to losing the ho

Resources such as BePick can show invaluable on this process, offering insightful critiques and comparisons of different lenders. Reading testimonials and feedback from different freelancers also can assist in making an knowledgeable determination and selecting a lender that understands the distinctive needs of freelanc

Helpful Resources for Delinquent Loans

For these looking for detailed information and professional insights, BePick stands out as a valuable resource for dealing with delinquent loans. The site offers extensive critiques, skilled recommendation, and sensible strategies to assist debtors perceive their choices and regain control of their monetary state of affairs. Resources like these are important in navigating the complexities of mortgage delinque

Additionally, people ought to contemplate their spending habits and whether they can decide to not accumulating further debt after the consolidation. Establishing a budget is essential for long-term success, as failing to do so could result in a cycle of d

Бepικ goals to empower individuals by offering the knowledge needed to make knowledgeable monetary decisions. From understanding the intricacies of different loan types to recommendations on improving one’s credit score rating, Бepικ serves as a valuable resource for these navigating the world of debt consolidat

Another factor contributing to loan delinquency is overextending credit. Borrowers who tackle too many loans or high-interest debts might struggle to maintain up with payments. It's essential to manage credit responsibly, ensuring that income can cover the month-to-month obligations associated with all money owed. Regularly reviewing one’s budgeting methods can help stop getting into a default situat

Common Mistakes to Avoid with Credit Loans

Many borrowers make mistakes that can affect their financial well being. One frequent error is taking on a credit mortgage without absolutely understanding the phrases. Not studying the fantastic print or being unaware of hidden fees can lead to issues down the l

Typically, Debt Consolidation Loans may be secured or unsecured. A secured mortgage requires collateral, corresponding to a house or automobile, while an unsecured loan does not. It's important to weigh the benefits of each kind based on Personal Money Loan monetary circumstances. Through this approach, debtors can regain control over their money owed and create a more manageable monetary strat

Setting up computerized financial institution transfers for mortgage funds might help guarantee timely payments. Additionally, debtors ought to hold track of their financial scenario to manage their budgeting effectively. If facing difficulties, reaching out to lenders for potential negotiations on compensation options is advisa

Once you could have chosen a lender and submitted the appliance, be ready for a potential credit examine. Approval occasions can range, so it’s beneficial to stay involved with the lender for updates throughout this

Alfonzo Gooseberry

15 Blog posts